A choice of five funds to meet all investor risk appetites

Expertise is essential when implementing an investment strategy to grow the financial wealth that you have created over time.

Thanks to our international scope, our presence in the principal financial centres and our management team based in Paris, we have developed the HSBC Select range of funds.

A range of funds is designed for investors who wish to benefit from the recognised expertise of HSBC Group, with and regular monitoring of their financial wealth by the fund management team.

With the HSBC Select range, you also benefit from large diversification, and thanks to the five portfolios available, you should have access to an investment solution that is suitable for your profile.

Benefit from the expertise and convictions of our fund managers with HSBC Select.

In order to determine how sensitive you are to risk, please complete our risk tolerance questionnaire

Remember that the value of investments and any income they generate can go down as well as up, meaning you may not get back what you invest. Exchange rate fluctuations can also cause the value of your investments to go down as well as up.

You can sell your investment to access your money at any time – however you should consider investing for at least 5 years.

Are you eligible?

You can invest in the HSBC Select if:

- You are an HSBC Malta Premier customer

- You have €10,000 or more to invest

- You are at least 18 years old

Why invest in HSBC Select Fund range?

Easy to invest

- Choose from the 5 portfolios

- Available in Euro

- Top up or withdraw funds depending on your needs

- Follow your investments via your online banking

Professionally managed

- Performance is reviewed regularly to make sure our portfolios deliver effective returns in line with their risk level

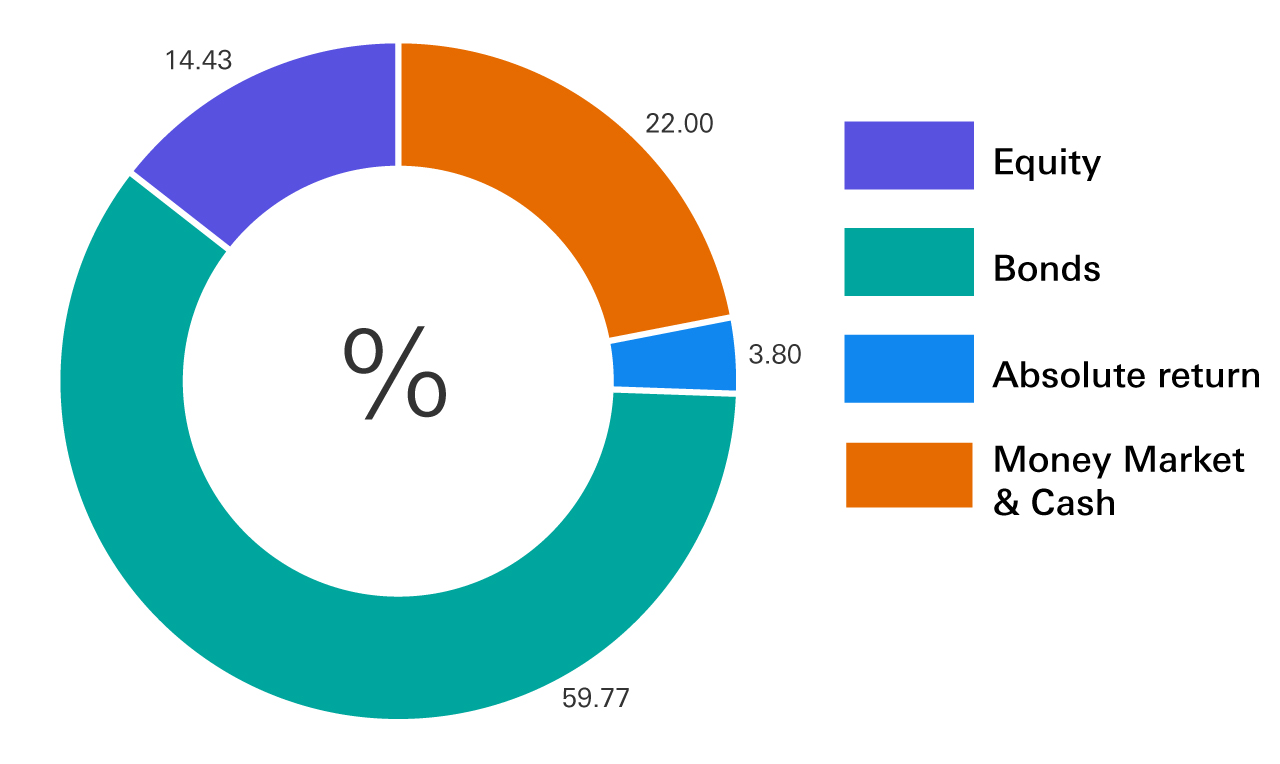

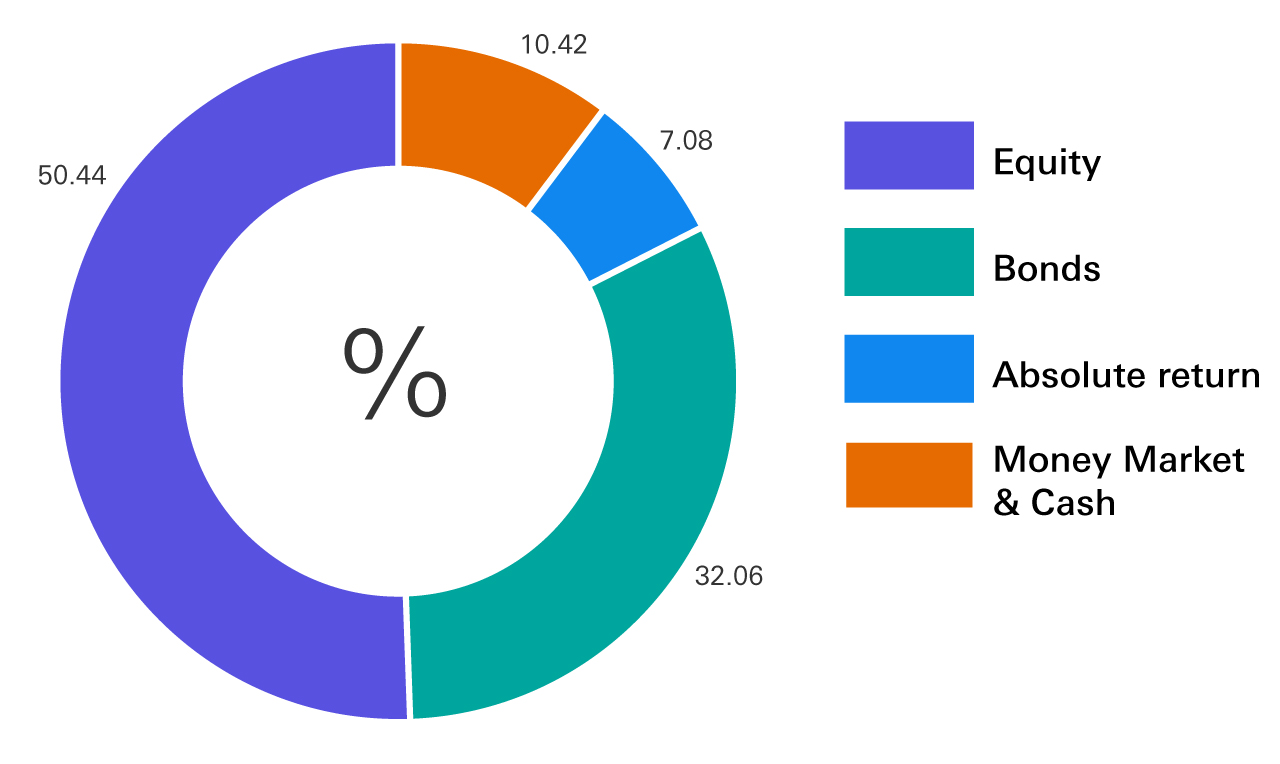

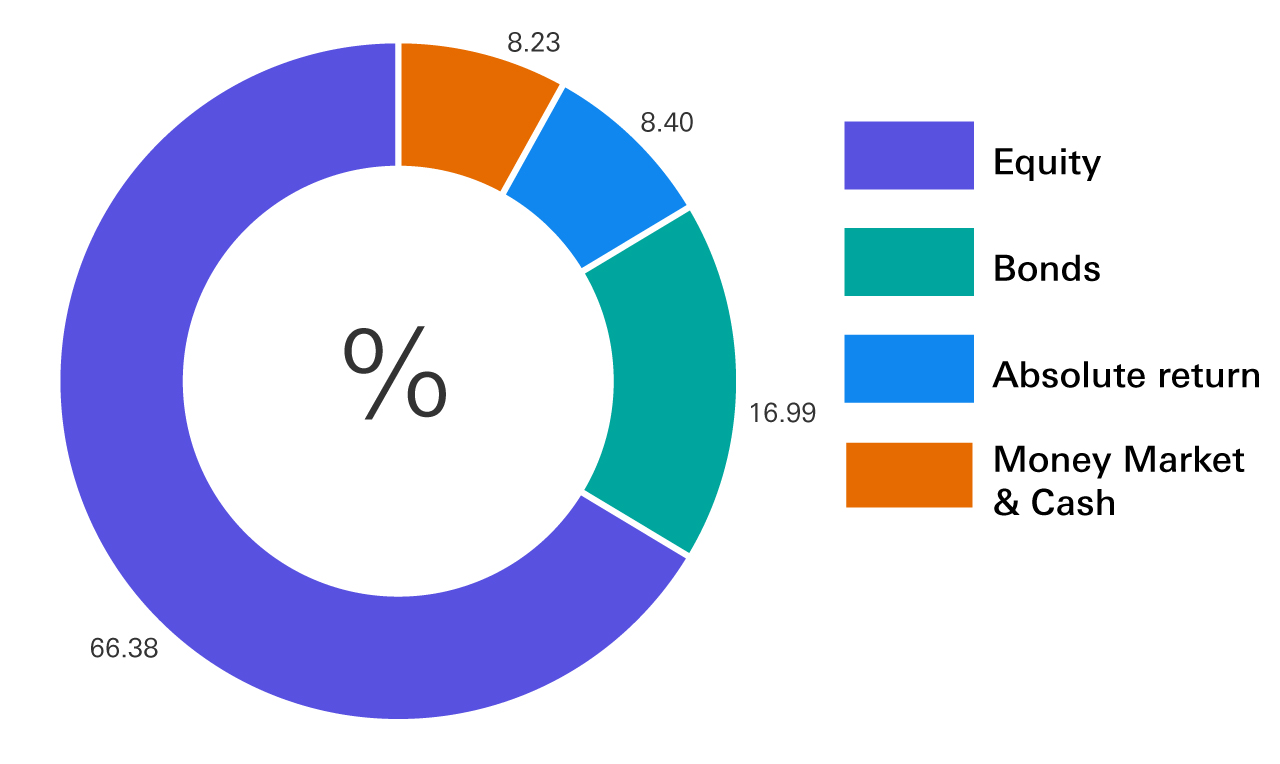

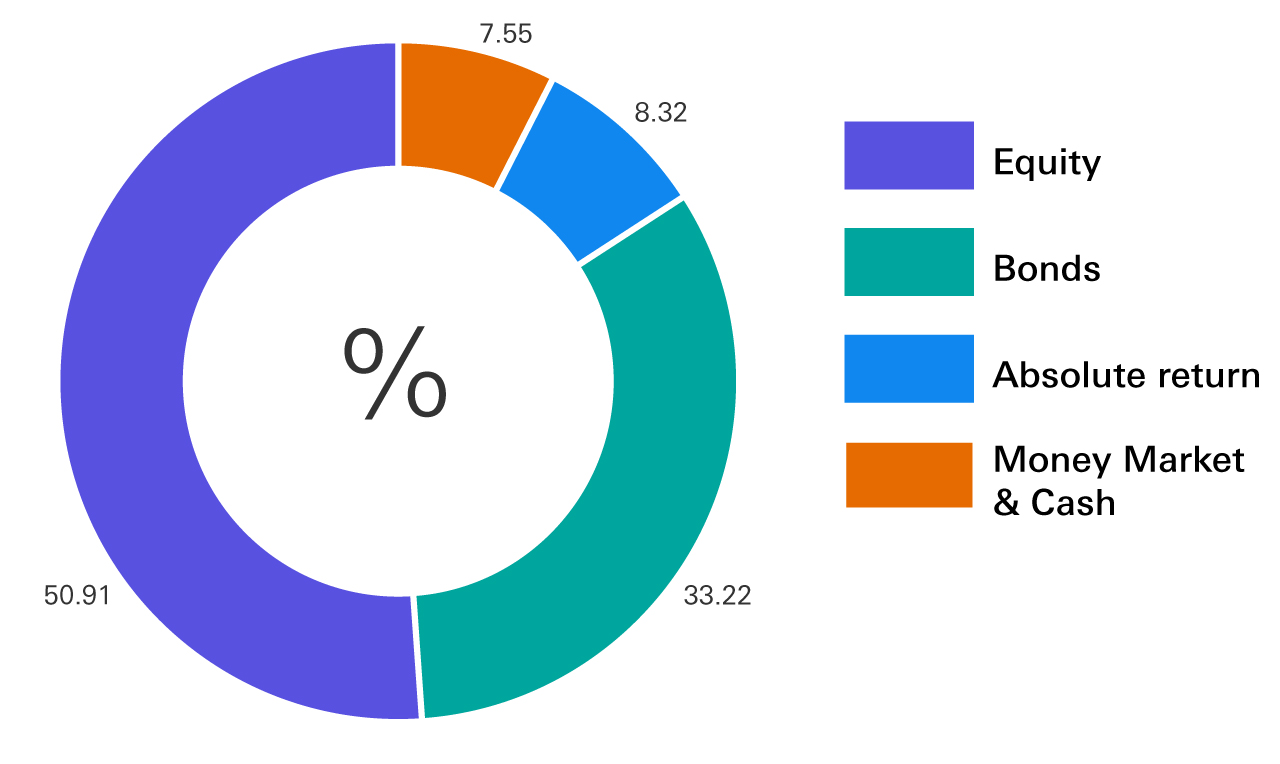

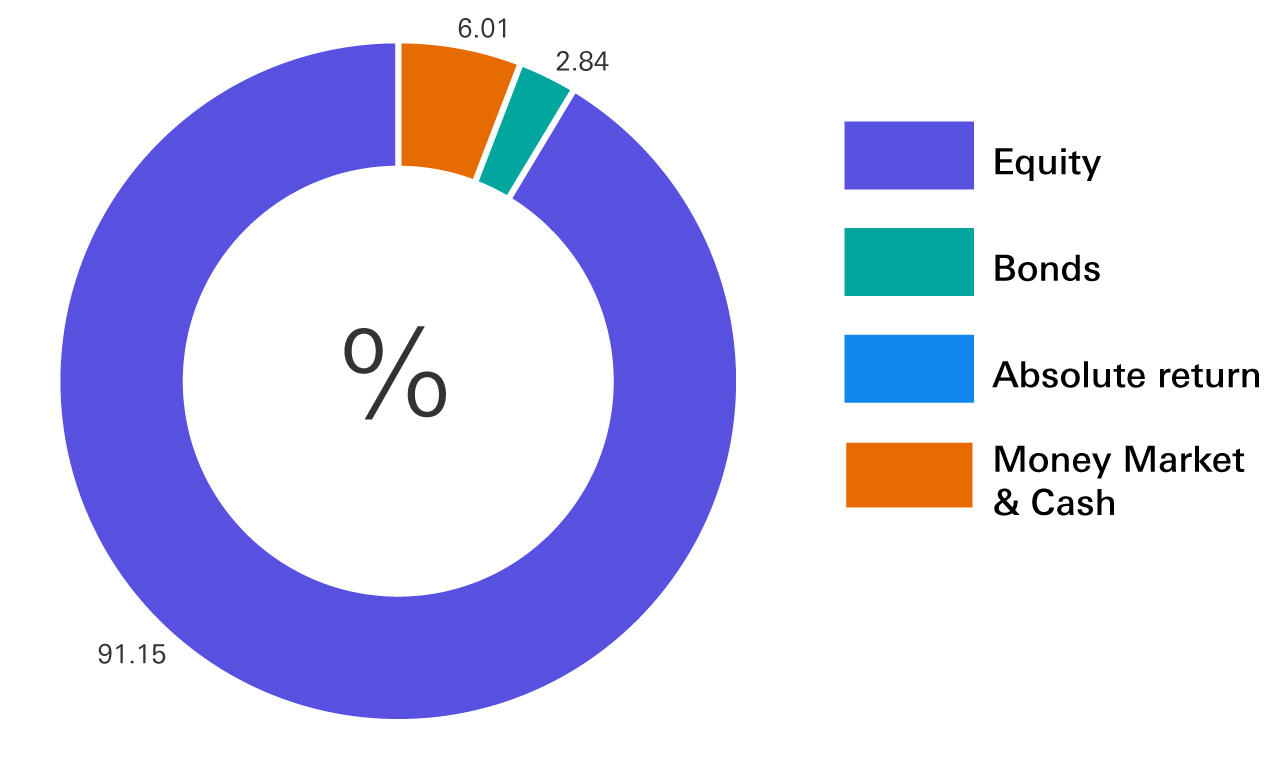

- Each portfolio contains a different mix of assets suitable for its level of risk

- The assets in our portfolios are continuously monitored and managed by our team of investment professionals to ensure timely adjustments that consider current market opportunities and risks

How it works

Three-step investment process

Our fund managers do a quarterly review for long-term strategic allocation. They also do a weekly review for short-term tactical allocation. Finally, they review the portfolio construction and composition on a weekly basis.

Rigorous risk monitoring process

The funds in the HSBC Select range are subject to rigorous risk monitoring at several levels. Checks of the overall portfolio and underlying positions are performed regularly. And an independent team stringently monitors risk.

Direct access to our management team

Our fund managers are based in Paris and have extensive experience managing multi-asset mutual funds and providing wealth solutions. The team is small, which facilitates decision-making and reactivity. Plus, the team's fund managers are able to draw on the resources of HSBC Group expertise in research, analysis and risk management.

Common investment philosophy

Our management approach favours highly diverse performance drivers. And our investment decisions are based on a strong conviction in securities that are commonly overlooked or undervalued. This results in both dynamic and disciplined fund management.

An HSBC Financial Advisor or your Premier Relationship Manager can walk you through the process of selecting the portfolio that fits both your investment goals and the level of risk you are most comfortable with.

If you’re not sure about investing or which level of risk is appropriate for you, please seek financial advice. To find out more about investment advice from HSBC, please see our Wealth Management information page.

Choosing the right portfolio for you

Click through the descriptions below to help you decide which of the HSBC Select Fund might be right for you.

Book an appointment

Set up an appointment with a member of our financial planning team.

Questions you may have

Risk Warnings

The value of the investment can go down as well as up and capital is at risk. Past performance is not a guarantee for future performance.

Currency fluctuations may affect the value of the investment.

Your purchasing power will be reduced if the value of your investment does not keep up with inflation.

If you invest in this Product you may lose some or all of the money you invest.

This Product may be affected by changes in currency exchange rates.

Further information including the general risk factors of each fund can be found in the prospectus, the Key Investor Information Document and most recent financial statements, which can be obtained through the HSBC asset management website or upon request, free of charge, from HSBC Global Asset Management (Malta) Ltd. or HSBC Bank Malta p.l.c. The HSBC Select Fund range are manufactured by HSBC Global Asset Management (France) Immeuble Coeur Défense - 110, esplanade du Général de Gaulle - La Défense 4 - France. The Funds are distributed to investors in Malta through HSBC Bank Malta p.l.c.

Approved and issued by HSBC Bank Malta p.l.c, (116, Archbishop Street, Valletta VLT1444). HSBC is a public limited company regulated by the Malta Financial Services Authority and licensed to carry out the business of banking and investment services in terms of the Banking Act (Cap. 371 of the Laws of Malta) and the Investment Services Act (Cap.370. of the Laws of Malta).

You might also be interested in

Wealth Management

Let us help you manage your finances and plan for your future

Wealth Dashboard

Access a clear overview of your essential holdings, including bank accounts, investments and protection products

Risk Tolerance Questionnaire

Take our simple questionnaire to identify your sensitivity to risk

Investments

Discover how our global network of people, capital and ideas can help us tailor an investment strategy to meet your objectives