Increasing awareness among investors on sustainability issues influencing the running and operations of businesses and corporations has contributed to a surge of various responsible investment ideas. Nowadays, investors are presented with more investment options through which they can manage their wealth while contributing to the common good of society and to a far more sustainable environment.

The main pillar of responsible investing is ESG integration. Environmental, social and governance (ESG) issues can have a material effect on company fundamentals and performance over the longer term. Evaluating how companies manage their impact on the environment, their relationships with stakeholders and their operations enables investors to identify potential risks and opportunities which financial markets may not price appropriately.

Undoubtedly, for quite some time, environmental issues attracted much of the investors' attention within the context of responsible investment. Climate change, extreme weather and the loss of biodiversity are still on top of the agenda for many organisations. Nature was also the theme of the day on the first Saturday of the United Nations Climate Change Conference (COP26) late last year, with discussions focused on forests, land use change and agriculture.

It is equally interesting to see that investors are also keen to see various businesses adopt good social and governance practices. Evidently, we are shifting away from an economy where labour was simply a cost concern. The social factor relates to the way companies manage their relations with their own employees, customers and the communities in which they operate.

Companies which fail to have a proper management of social considerations are likely to be exposed to severe reputational and financial risks. In fact, the outbreak of COVID-19 led the public to become more concerned over social issues, typically supply chain disruptions due to lockdowns and cybersecurity risks brought by the shift to remote working. These risks significantly weigh on the economy and corporate earnings, raising the awareness about corporate social risk policies among investors.

Corporate governance deals with a company's leadership, executive pay, audits, internal controls, regard for shareholder's rights, business ethics and culture, and diversity and structure of the board of directors. Companies with good governance practices such as diversity, equality, and inclusion tend to reduce risk for investors and improve the financial performance of the company, attracting investors. In fact, regulators, asset owners and investment consultants have been increasing their focus on embedding these values in their ESG screening processes and active engagement to enhance investor value.

Integrating ESG considerations in investment decisions can not only manage risks but also unlock new investment opportunities. In fact, it has been estimated that trillions of dollars are needed to decarbonise our economies. The stark reality of this situation is that governments worldwide are expected to finance less than a third of such expense.

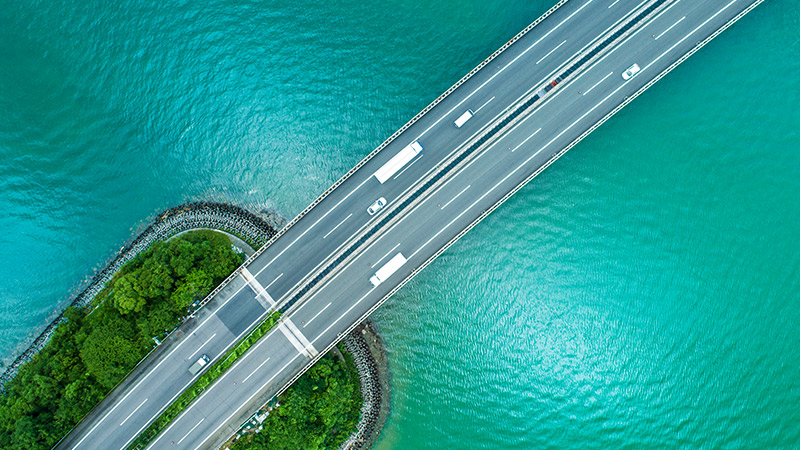

On the environmental front, climate change presents material company risks that can impact share prices but also opportunities for those companies who take measures to reduce carbon footprint. More companies are resorting to sources of renewable energy and making use of green buildings such as geothermal systems, solar panels and efficient water recycling systems. Other investment themes include sustainable water and waste-water management and clean transportation.

COP26 also marked another significant step in the rise of sustainable finance. In 2022, further acceleration in the issuance of green bonds is expected. Green bonds are a fixed income instrument issued by private companies, financial institutions and governments to fund projects with environmental and/or climate benefits. Developed countries have dominated the green bond market and still represent 75 per cent of total volumes. However, activity is expected to shift to emerging markets, particularly Asia, providing opportunities for investors looking for green bonds to reduce their investments to those with high climate change risks.

The commitment by the countries across the globe to transition to a net zero carbon economy is leading to new opportunities to invest in new asset classes such as sustainable infrastructure debt or natural capital, also known as alternative investments. This is shifting the concentration of responsible investments which to date have been largely concentrated in equities. In addition, a great deal of investment is expected to be in the developing world, leading to a geographical shift in investment from developed markets. This is where the population is growing most rapidly, where urbanisation is at its most profound and where economic growth is more rapid. As a result, this is where sustainable infrastructure will be the most impactful.

To help investors explore such opportunities and make better investment decisions to choose the right investment products, regulators around the world have introduced various new regulations to strengthen corporate ESG disclosure, reduce the risk of misinformation and facilitate comparison of ESG metrics among different companies.

As can be seen, this shift is creating opportunities from the development of new sectors, technology or business models. However, there is no 'one-size-fits-all' solution, and hence a financial adviser can provide you with innovative solutions that can support your ambition to allocate your investments more sustainably, while seizing new long-term investment opportunities.

Speak to our relationship managers to explore sustainable investing opportunities that could help meet your goals. If you are interested in learning more about sustainable investments and ESG, visit our Investment Academy.

This article was written by Lisa Vella, CEO of HSBC Global Asset Management (Malta) Limited. It first appeared in The Times of Malta on 9 May 2022.